Checking Accounts

At DeMotte State Bank, we value the dollar, whether it’s yours or ours! At our community bank, we offer three different checking account options: DSB Prime Rewards Checking, Choice Rewards Checking, and Freedom Checking. Take a moment to consider the features that appeal to your needs and financial goals, depending on your stage of life. A New Accounts Representative at your local branch can help you determine the best checking account to fit your life!

Your Checking Account Choices

Find the account that fits your lifestyle.

Prime RewardsChecking |

Choice RewardsChecking |

FreedomChecking |

|

| Buyer’s Protection & Extended Warranty*/** Items are protected for up to $2,500 per item if theft OR accidental breakage occurs during the first 180 days of purchase, using your BaZing checking account. |

|

|

|

| Roadside Assistance Available 24/7 and free to use, up to $80 covered in service charges. |

|

|

|

| Health Savings Card Save money on prescriptions, eye exams, frames, lenses, and hearing services. |

|

|

|

| Cell Phone Protection*/** Receive up to $400 per claim ($800 per year) if your cell phone is broken or stolen. |

|

|

|

| ID Theft Aid*/** Includes payment card fraud resolution, $2,500 in personal identity theft benefit and identity restoration. |

|

|

|

| $10,000 Travel Accidental Death Coverage** Peace of mind for the unexpected. |

|

|

|

| Shop Local, Save Local with BaZing Savings Local discounts and national retailer deals to save you money on shopping, dining, travel & more. |

|

|

|

| Great Interest on Your Checking Balance*** Our best checking account rate. |

|

||

| Bill Pay |  |

|

|

| Free Paper Statements |  |

|

|

| Monthly Service Charge | Maintain a $2,500 average monthly balance and we’ll waive the $10 monthly fee. | Only $6/month. | $7/month waived if you maintain a $250 average monthly balance OR have 30 qualifying debit card transactions. Paper statements $8/month. |

*Subject to the terms and conditions detailed in the Guide to Benefits.

**Insurance products are: NOT A DEPOSIT. NOT FDIC-INSURED. NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY. NOT GUARANTEED BY THE BANK.

***Tiered Interest (Calculated on daily collected balance)

Contact a New Accounts Representative for other requirements, rates, and fees that may apply.

RoundUp Savings

Save every time you spend with RoundUp Savings. This checking account feature allows you to effortlessly save on each transaction you make by rounding up the change to the nearest dollar and depositing the difference into your linked DSB savings account.

Understanding Our Overdraft Services

A clear look at your coverage choices.

Overdraft Protection |

Overdraft Privilege(ODP) |

Overdraft Privilege(Must Opt-In) |

|

Who |

Customers with two or more DSB accounts, one account must carry a minimum balance of $25 to remain in Overdraft Protection. | Customers whose account(s) are in good standing | Customers whose account(s) are in good standing |

What |

Contractual agreement which requires a signature |

A privilege extended to eligible customers age 19+ | An optional feature for eligible customers age 19+ |

How |

It prevents overdrawing by using funds from a linked account | Allows account to be overdrawn through checks and ACH transactions only | Allows account to be overdrawn through ACH, Debit Card Transactions, Checks, and ATM withdrawals |

Fees* |

$25.00/year & $10.00/transfer | Non-Sufficient Funds Fee $35.00/item | Non-Sufficient Funds Fee $35.00/item |

Exceptions |

A Non-Sufficient Funds Fee ($35/item) will not be assessed unless an account becomes overdrawn by more than $10.00 | A Non-Sufficient Funds Fee ($35/item) will not be assessed unless an account becomes overdrawn by more than $10.00 | A Non-Sufficient Funds Fee ($35/item) will not be assessed unless an account becomes overdrawn by more than $10.00 |

*Account will be charged $35.00 every 5 business days if it remains overdrawn

ACH Payments

Transfer funds to an account at another financial institution. E.g. direct debit, automatic bill payment

Item

A transaction on your account, i.e. a purchase made or a cash withdrawal from your account

Student Account

Begin your financial journey with the perfect checking account.

What’s a Student Account?

This checking account is tailored specifically for ages 13-22. With no monthly maintenance fee or balance requirement, the DSB Student Account provides a perfect opportunity to learn essential financial life-skills.

Intentional Learning Environment: With safety guidelines in place, such as no ACH Debits, Checks, or Overdraft Services, our Student Account ensures a safe and controlled learning environment.

Hands-On Experience: The best way to learn is by doing. Whether it’s depositing a paycheck from their first job, setting up savings goals, or tracking expenses, students can experience practical, real-world financial management.

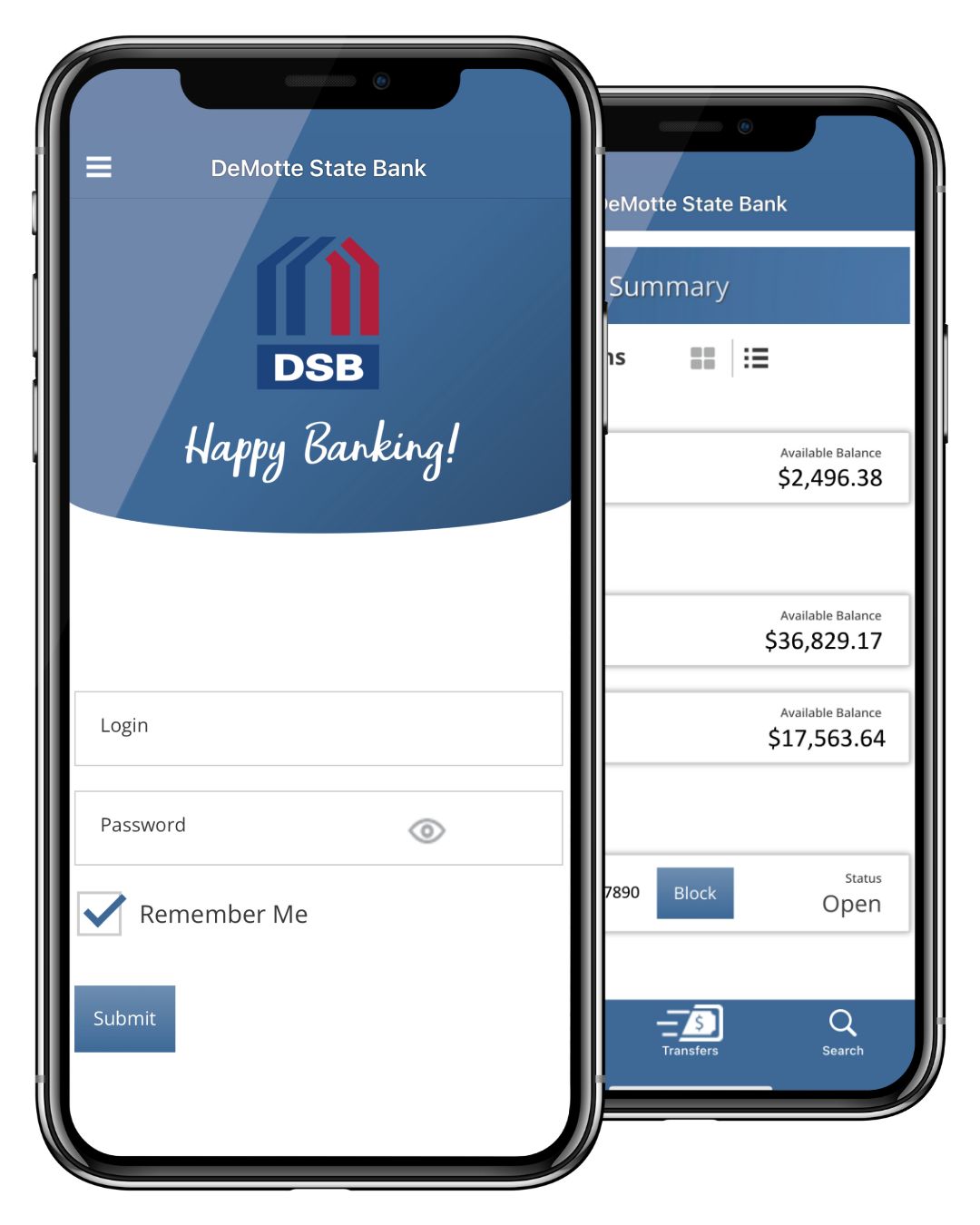

Parental/Guardian Oversight: The DSB Mobile Banking app provides many resources for Parental/Guardian oversight. View your student’s account balance, add account and/or card alerts, and enjoy seamless internal transfers.

Key Features

Contactless Debit Card

Experience the ease of our contactless debit card. Add your debit card to your mobile wallet for additional security.

Mobile Banking App

Check your balance and make transfers within your accounts with the touch of a button.

No Monthly Maintenance Fees

Enjoy the bliss of a fee free checking account.

No Balance Requirements

No monthly balance requirement to worry over.

Debit Card Information

- To temporarily turn off your debit card please log into your DSB Mobile Banking App and select the card you would like to turn off.

- If your debit card is lost or stolen please call 1-877-226-2351.

BaZing Savings App

Use the free BaZing mobile app to receive discounts from local businesses. Additionally, the BaZing app will send you notifications of available discounts when you are near a participating store.

At the point of sale, simple show your mobile coupon to receive the discount. Or you can print a paper coupon from BaZing.com.

*Must hold a Prime or Choice Rewards Checking Account.

Your Saving & Investment Choices

We are invested in our communities, personally and professionally. Because of our close ties with the communities we serve, we are passionate about providing competitive savings and investment options to meet your long-term and short-term goals. One of our New Accounts Representatives would be happy to discuss your objectives and find solutions. Visit with us at your local DSB location soon.

Credit Card Information

Issued by Bankers Bank

- To apply for credit card with DeMotte State Bank please click here*

- If your credit card is lost or stolen please call 1-800-423-7503

*Must be a DeMotte State Bank customer to apply. Credit approval needed. Fees may apply.

Mobile Banking for Anywhere at Anytime

Your banking needs in one place.

DSB Mobile Banking App