Business Checking

For more than 100 years of banking, we have believed in local business. We strive to offer financial solutions that fit your business, whether you’re just starting up, building a current business, or managing a commercial operation. With our attention to detail, professional knowledge, and ability to personalize banking, we will serve you with a commitment to excellence. At DSB, we put our communities and local businesses first, and we can’t wait to show you the benefits of hometown banking!

Free Business Checking

Opening deposit requirement $100

$1000 minimum average balance*

Free Business Debit Card

Free ACH items

Free 50 paper items per month**

Free Basic Internet Banking

Free E-Statement***

*$5.00 monthly service fee if average balance falls below $1,000

**$0.35 per excess of 50 items per month

***Paper Statement – $8 per month

Business PRO Checking

Opening deposit requirement $100

No minimum average balance requirement

$10.00 flat monthly service fee includes:

-

-

- All paper and ACH items

- Business debit card

- Basic PLUS Cash Management

- E-Statements or Paper Statements

- Notary Service

- Online Banking with FREE Bill Pay Services

-

Additional Services

- Optional Overdraft Services

- Merchant Services

- Business Credit Card

- Positive Pay

- RoundUp Savings

Contact us for other requirements, rates, and fees that may apply.

Understanding Our Overdraft Services

A clear look at your coverage choices.

Overdraft Protection |

Overdraft Privilege(ODP) |

Overdraft Privilege(Must Opt-In) |

|

Who |

Customers with two or more DSB accounts, one account must carry a minimum balance of $25 to remain in Overdraft Protection. | Customers whose account(s) are in good standing | Customers whose account(s) are in good standing |

What |

Contractual agreement which requires a signature |

A privilege extended to eligible customers age 19+ | An optional feature for eligible customers age 19+ |

How |

It prevents overdrawing by using funds from a linked account | Allows account to be overdrawn through checks and ACH transactions only | Allows account to be overdrawn through ACH, Debit Card Transactions, Checks, and ATM withdrawals |

Fees* |

$25.00/year & $10.00/transfer | Non-Sufficient Funds Fee $35.00/item | Non-Sufficient Funds Fee $35.00/item |

Exceptions |

A Non-Sufficient Funds Fee ($35/item) will not be assessed unless an account becomes overdrawn by more than $10.00 | A Non-Sufficient Funds Fee ($35/item) will not be assessed unless an account becomes overdrawn by more than $10.00 | A Non-Sufficient Funds Fee ($35/item) will not be assessed unless an account becomes overdrawn by more than $10.00 |

*Account will be charged $35.00 every 5 business days if it remains overdrawn

ACH Payments

Transfer funds to an account at another financial institution. E.g. direct debit, automatic bill payment

Item

A transaction on your account, i.e. a purchase made or a cash withdrawal from your account

RoundUp Savings

Save every time you spend with RoundUp Savings. This checking account feature allows you to effortlessly save on each transaction you make by rounding up the change to the nearest dollar and depositing the difference into your linked DSB savings account.

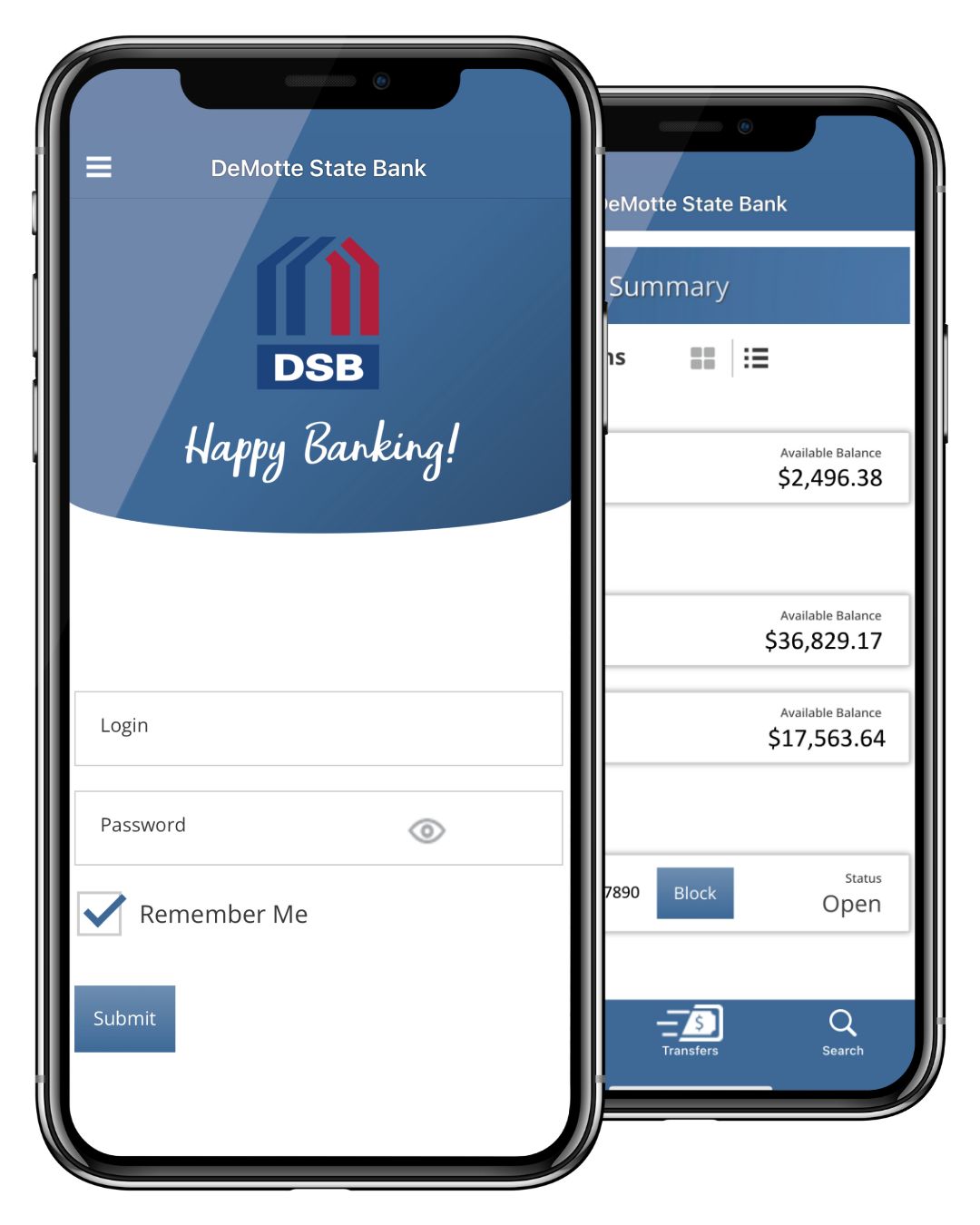

Debit Card Information

- To temporarily turn off your debit card please log into your DSB Mobile Banking App and select the card you would like to turn off.

- If your debit card is lost or stolen please call 1-877-226-2351.

Positive Pay Processing

Positive Pay Processing is a tool used to help prevent fraudulent checks from posting against commercial accounts. By sharing key information with DSB about the legitimate checks your institution issues and authorized ACH debits, DSB and our Business Banking Customers can more fully control, monitor, and review out-going ACH and paper payments therefore detecting potential fraud. Contact your DSB branch for more information regarding this service.

If you are a current Positive Pay Business Customer click here to log in.

Your Lending Experts

Our community-based lenders offer competitive interest rates and a variety of terms. We have the hometown bank advantage of personalized lending. As expert lenders, we are dedicated to providing you with tailored solutions to fit your business banking needs.

It’s time to work with a lender who is committed to utilizing their extensive lending knowledge while delivering exceptional customer service.

Credit Card Information

Issued by Bankers Bank

- To apply for credit card with DeMotte State Bank please click here*

- If your credit card is lost or stolen please call 1-800-423-7503

*Must be a DeMotte State Bank customer to apply. Credit approval needed. Fees may apply.

Your banking needs in one place.

DSB Mobile Banking App